The Journey of Getting a Tax File Number by Erin Byers

The simultaneous thrill and nightmare of getting a first job is what many people, especially teenagers, go through. When you reach the age to become eligible for a job, one of the requirements that many young people may not be aware of is that you need a Tax File Number (TFN). You need to have a TFN because your employer is required to deduct income tax from your wages. It is illegal to work in paid employment without paying tax.

If you do not have a TFN, you may be taxed more than necessary later or not be able to get government benefits which you are entitled to receive. Without a TFN, tax will be deducted from your income at the maximum rate. You can claim this back later once you submit a tax return (more on that later), but it is more convenient to have a TFN and have the correct amount deducted from the start.

Now that you understand why you need a tax file number to work legally, the next step is to actually get one. How you apply for one will differs depending on the circumstances. These can include:

• Australian residents

• Foreign passport holders, permanent migrants and temporary visitors

• People living outside Australia

You can apply for a TFN by downloading and completing an application for people living outside Australia, which can be found at the ATO website.

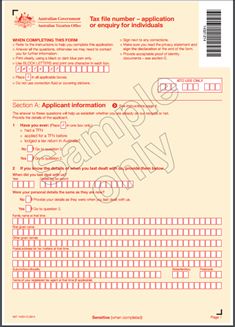

A tax file number application can be filled out by the person needing the TFN, or on behalf of another person who needs help. If you know somebody with literacy difficulty or a disability which renders them unable to apply themselves, you can assist them with their application.

See more at: https://www.ato.gov.au/Individuals/Tax-file-number/